2005 +

In business since

Credit Repair

What is Credit Repair Services?

Credit Sweeps or Credit Repair Services is the process of addressing and removing the questionable negative items that are impacting your credit profile. In fact, over 40 million Americans are victims of inaccurate or unfair negative items wrongfully lowering your score. Most don’t even know, are you one of them?

As leaders in the credit repair industry, we address, attack and remove all inaccurate, obsolete & unverifiable items on your credit report. Not only do we attack and remove all negatives reported but also block them from ever reappearing on your credit life. To remove a negative item, credit reporting agencies will require you to work through their complicated online systems and send a series of formal dispute letters. To make the disputing process easy & efficient, our Credit Repair Team will identify and challenge questionable negative items on your behalf using our patented credit repair process.

How long do Credit Sweeps take?

Unfortunately, there’s no way to predict in advance how long it will take to repair your credit, as every credit report is unique. We help thousands of people each year repair their credit, and typically with our Credit Sweep Program they’ve stayed with us for 45 to 60 days. With our team of professionals, patented credit repair software and years of experience, our removal process is streamlined to get you fast results. We are your Credit Repair Experts!

Credit Repair Sweep: The Fastest Way to Clean Your Credit Report in 45–60 Days

If you're struggling with a low credit score due to collections, late payments, or other derogatory items, you're not alone. Millions of Americans face the same challenge. Fortunately, there's a powerful and efficient solution — the credit repair sweep.

A credit repair sweep is one of the fastest ways to remove negative items from your credit report. Whether you're trying to buy a home, finance a vehicle, or qualify for a high-limit credit card, a properly executed sweep can make the difference between approval and denial.

A credit repair sweep is a rapid, strategic process used to clean up a credit report by challenging and removing derogatory information...

A credit repair sweep works by leveraging consumer protection laws — primarily the Fair Credit Reporting Act (FCRA)...

✅ Hard Inquiries

✅ Collections

✅ Charge-Offs & Late Payments

✅ Bankruptcies

✅ Repossessions & Foreclosures

✅ Judgments & Tax Liens

1. Faster Credit Score Increases

2. Better Loan Approvals

3. Peace of Mind

4. Increased Credit Card Limits

5. Access to Housing

✅ Proven Results in 45–60 Days

✅ Full-Service Dispute Process

✅ Inquiry Removal Included

✅ Affordable & Transparent Pricing

✅ Secure, Private & Confidential

A credit repair sweep is ideal for individuals who:

* Need rapid credit improvement for a home or auto loan

* Want to clean their report before applying for funding or business credit...

1. Schedule a Free Consultation

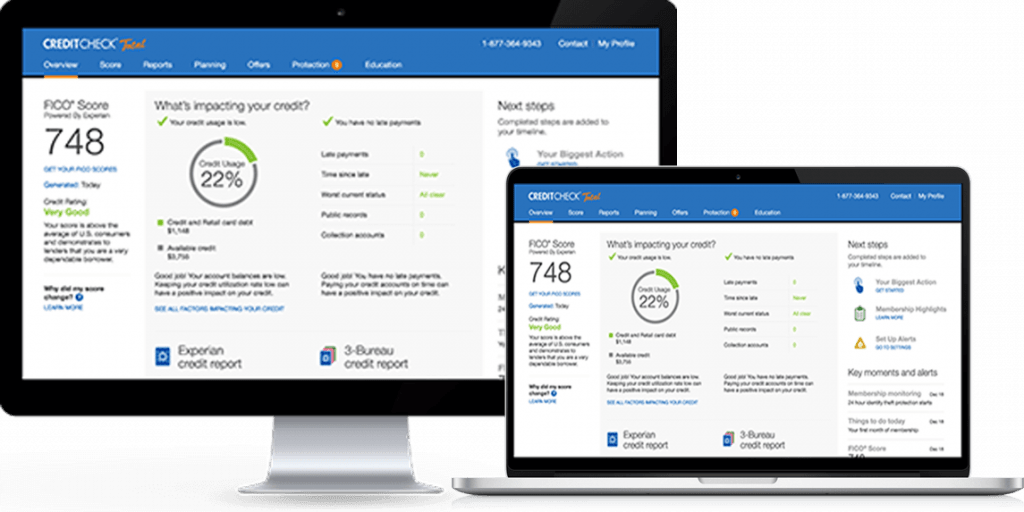

2. Send Us Your Credit Reports

3. We Start the Sweep

4. Watch the Changes

Is a credit repair sweep legal? Yes...

Can legitimate debts be removed? Yes...

Will the negative items come back? In rare cases...

Will this help with a thin credit file? Yes, when paired with tradelines...

Can I do it myself? Possible, but professional help improves results.

Let’s Clean Your Credit — Fast

You don’t have to live with bad credit. If your score is holding you back, now is the time to act. Our credit repair sweep is the fastest, most reliable way to wipe away the damage and build the credit you deserve.

We remove all inaccurate, obsolete & unverifiable items on

your credit report including;

Collections

Inquiries

Late Payments

Charge Offs

This is the heading

Student Loans

Credit Repair: A Complete Guide

to Credit Sweeps

For millions of Americans, credit serves as the key to unlocking financial opportunities. Whether you are trying to buy a home, finance a vehicle, obtain a personal or business loan, or qualify for a new credit card, your credit history is at the center of the decision-making process. Unfortunately, life’s challenges can sometimes lead to damaging marks—late payments, collections, repossessions, bankruptcies, or even the fallout from identity theft.

This is where credit repair—often referred to as credit sweeps—comes in.

In business since 2005, our company has helped thousands of clients take control of their credit and reclaim their financial future. Over the years, we’ve built a reputation for delivering results-driven credit restoration backed by a proven process, personalized attention, and an unwavering commitment to compliance. In this detailed guide, you’ll learn what credit sweeps are, how they work, who they benefit, and why they are important. We’ll also touch on the history of credit repair, compare interest rates for good vs. bad credit, highlight special cases like student loans and identity theft, and explain how pairing credit sweeps with authorized user tradelines can produce maximum results.

What Is Credit Repair (Also Known as Credit Sweeps)?

Credit repair is the process of challenging and removing inaccurate, unverifiable, or outdated information from your credit reports. In the industry, this is often called a credit sweep because it involves a thorough review and “sweeping” away of any negative accounts that don’t belong there.

Unlike DIY disputes that can drag on for years, credit sweeps are structured, targeted, and managed by professionals who know the credit reporting laws inside and out. The purpose is not to manipulate the system—it’s to ensure that creditors and credit bureaus only report accurate and verifiable information.

No Data Found

Credit sweeps are an intensive form of credit repair aimed at removing multiple derogatory accounts from all three major credit bureaus—Experian, Equifax, and TransUnion—in a focused and efficient process. These may include:

- Late payments

- Charge-offs

- Collections

- Repossessions

- Medical bills

- Foreclosures

- Bankruptcies

- Judgments

By reviewing and challenging every questionable account, the process aims to leave a clean foundation on which to build positive credit history.

Credit repair sweeps are performed using consumer protection laws like the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), and Truth in Lending Act (TILA). These laws require that every item reported to a credit file must be accurate, verifiable, and timely.

Here’s how it works:

- Credit File Review – Pull reports from all three bureaus and identify derogatory items.

- Documentation – Collect identification, proof of address, and relevant supporting records.

- Disputes and Challenges – Draft personalized dispute letters to send to credit bureaus, creditors, or collection agencies.

- Verification Process – Creditors and bureaus must verify accounts within specific timeframes; if they cannot, the items must be removed.

- Results and Updates – Clients receive updates showing deletions or corrections, often resulting in noticeable score improvements.

Credit sweeps are used by people in many situations, such as:

- First-time homebuyers

- Families seeking better auto loan rates

- Entrepreneurs in need of capital

- College graduates burdened by loans

- Victims of identity theft

- Those recovering from economic downturns like the 2008 recession or COVID-19 pandemic

All share a common need: a clean, credible financial profile to reach their goals.

The benefits of a credit sweep extend into nearly every area of personal finance:

- Qualifying for better mortgage rates

- Securing affordable auto financing

- Getting approved for high-limit credit cards

- Being accepted for apartment leases

- Applying for business loans or vendor accounts

Lowering insurance premiums

A cleaned-up credit report can lead to:

- Higher credit scores

- Better loan approvals

- Lower interest rates—saving thousands over time

- Peace of mind from knowing your report is accurate

- More confidence in pursuing financial goals

The difference between excellent and poor credit is often most visible in interest rates:

- Excellent credit: ~5% mortgage rate

- Poor credit: 9% or higher

On a $300,000 loan, that’s hundreds more per month and over $100,000 extra over the life of the mortgage. The same applies to car loans, credit cards, and personal loans—making credit sweeps a wise financial move.

When reviewing applications, lenders focus on:

- Credit Score – Higher scores generally open the door to more approvals, lower interest rates, and better repayment terms.

- Credit History – Lenders review how long you’ve had credit, the types of accounts you’ve managed, and your overall payment record. A well-rounded history that shows responsible management of both revolving and installment credit is ideal.

- Debt-to-Income Ratio – This measures how much of your income is already committed to debt payments. A lower ratio signals to lenders that you can comfortably manage additional credit without financial strain.

Credit sweeps remove inaccuracies, outdated items, and unverifiable accounts, which can directly improve these key factors. By eliminating harmful entries and ensuring your report reflects only accurate, positive information, you increase your chances of approval for mortgages, auto loans, personal loans, and business credit. A cleaner profile not only helps with approval but often results in higher credit limits and more favorable loan terms.

Credit repair has been around for decades but became more mainstream in the 1990s as consumers learned about their rights under the FCRA. Online credit report access accelerated its growth.

After the 2008 recession, millions turned to credit sweeps to recover from foreclosures, bankruptcies, and mass layoffs. The COVID-19 pandemic created another wave of demand as missed payments and collections mounted.

Legalities of Credit Sweeps

Restored personal credit often leads to stronger business credit opportunities. Good personal scores make it easier to secure business loans, credit lines, and corporate credit cards—allowing entrepreneurs to expand and grow with confidence.

When your personal credit is solid, lenders and vendors are more inclined to extend favorable terms and higher limits. This credibility can be leveraged to establish a strong, separate business credit profile over time—unlocking access to funding sources that eventually require little or no personal guarantee. Many successful entrepreneurs credit the combination of clean personal credit and robust business credit as the key to scaling their operations.

Both the 2008 recession and COVID-19 crisis caused widespread credit damage for millions of Americans. Mass layoffs, reduced income, and unexpected expenses resulted in late payments, charge-offs, and collections appearing on countless credit reports.

Credit sweeps provided a structured, legal solution for removing outdated or inaccurate negative items, enabling faster recovery. By addressing the credit issues caused during these downturns, individuals were able to regain financial stability, qualify for loans again, and begin rebuilding their lives. In many cases, this process was the difference between being stuck in financial limbo and moving forward toward homeownership, business growth, or other major financial goals.

Delinquent student loans can severely harm credit, especially when they are reported incorrectly or listed multiple times. Credit sweeps help by correcting inaccurate reporting, removing outdated entries, and disputing errors—making it easier for borrowers to qualify for mortgages, car loans, or business financing.

Given the size of many student loan balances, even one late payment can have a long-lasting effect on a credit score. Correcting these issues not only improves credit standing but may also help borrowers access refinancing or consolidation options with better rates—reducing their long-term financial burden.

Identity theft can leave multiple fraudulent accounts, inquiries, and collections on your report. A credit sweep identifies and documents these items, then uses legal channels to have them removed—often far quicker than handling disputes alone.

By leveraging consumer protection laws and submitting documented proof of fraud, professionals can restore a victim’s credit integrity much faster. Without a targeted process like a credit sweep, victims could spend years trying to clear their records, facing obstacles in obtaining housing, employment, or financing.

Once negative marks are gone, adding authorized user tradelines can help build positive history quickly. By being added to a seasoned account with years of on-time payments, clients can see a substantial score boost—especially when paired with a clean file post-sweep.

An authorized user tradeline is a credit account—most often a credit card—owned by another person that you are added to as an “authorized user.” While the primary account holder is responsible for payments, the account’s positive history (age, payment record, and credit utilization) appears on your credit report.

When the account has a long track record of on-time payments, low balances, and no derogatory marks, it can significantly improve your score. This strategy works best immediately after a credit sweep because the clean report allows the positive history to have a greater and faster impact—helping you qualify for better credit cards, mortgages, auto loans, and even business funding.

Our Experience Since 2005

In business since 2005, we’ve helped thousands of clients successfully improve their credit. Our team offers personal guidance, clear updates, and full support from start to finish. We’ve built long-term trust by combining proven methods with transparent communication—ensuring clients feel confident and informed every step of the way.

Brokers and Resellers Are Welcome

We also partner with brokers and resellers, allowing them to offer credit sweeps to their own clients backed by our proven results.

Conclusion

Credit sweeps are about more than simply removing negative items—they’re about restoring financial dignity, unlocking opportunities, and building a secure future. When performed correctly, they provide a clean foundation for growth, allowing you to move forward with confidence and stability.

Since 2005, we have built our reputation on delivering comprehensive credit solutions tailored to each client’s needs. In addition to credit repair, we also offer:

- Authorized User Tradelines – Add positive payment history to your credit file for a fast score boost.

- CPN Numbers – Create a separate, clean credit profile for certain approved purposes.

- CPN Tradeline Packages – Pre-built packages combining CPN numbers with high-quality tradelines.

- Business Tradelines – Build and strengthen your business credit profile with accounts that report to commercial bureaus.

- Credit Repair Sweeps – Intensive file clean-up for faster results compared to traditional dispute methods. We remove fraudulent accounts, inquiries, late payments and collections from compromised credit files.

Whether you are an individual recovering from financial hardship, a family planning a major purchase, or a business owner looking to secure funding, our team is here to guide you through the process step-by-step. We also work with brokers and resellers, giving them the tools and support they need to expand their service offerings and help more clients achieve financial success.

With our decades of experience, proven strategies, and client-first approach, we are committed to delivering results that last. The combination of credit sweeps, authorized user tradelines, CPN packages, and business credit solutions creates a powerful roadmap to financial freedom.

No matter where you are starting from, the best time to take control of your credit is right now—and our team is ready to help you get there.